A few weeks ago, we wrote about the warning signals that social media had provided ahead of the storming of the US Capitol.

Less than a fortnight later, the power of social media to ring these warning bells has made the headlines again and we have seen its direct impact on stock markets around the world.

We are witnessing exponential stock price rises not seen since the dotcom boom, but these days the tip is not from a media pundit but instead a gathering on a social media platform. And regulators and governments are paying attention.

At Social360 we pride ourselves on our breadth of search and indepth analysis. We have always actively looked at investor chat rooms, highlighting any emerging discussion of significance to our clients. Historically participants in these chat rooms have been active retail investors sharing their knowledge, opinions and recommendations. Recently, we have seen a shift in who these retail investors are, what platforms they are using and most interestingly they are now working together in concerted way.

To be clear – what we are seeing here is not someone tipping a stock that they believe or know will perform beyond expectations. We are seeing a new wave of social media investors, taking stock positions not only to make money but also to make a point.

GameStop has proven to be a perfect example of this movement. This new group of investors looked at the stock and could see that hedge funds had shorted the stock so much that their positions represented more than 100% of stock.

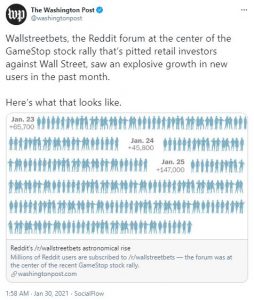

They grouped together and started buying the stock in small amounts – maybe just $500 or $5,000. However, as we all know these incremental purchases led to a huge amount of stock movement. Simple supply and demand will say price will go up as demand does and this began to happen. The short-selling hedge funds began to realise they had to buy stock to cover their short positions to minimise their potential losses. This in turn drove prices higher achieving astronomical gains for GameStop.

As these targeted stocks prices rose trading platforms used by small investors decided to block transactions in the stock, causing uproar as their ability to transact was taken away.

We will leave the argument around censorship and market manipulation for another day, as we watch regulators and government flounder around the new influence of social media to take control of a market situation.

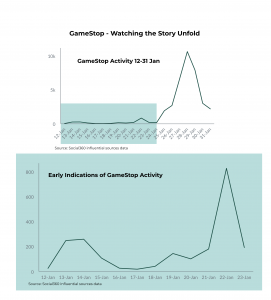

But the GameStop story has certainly highlighted how social media is broad and powerful and can effect changes and outcomes; how its warning signals cannot be ignored. We have analysed our inhouse data on social media discussion by influential authors and can see several blips in discussion around GameStop ahead of the story exploding last week.

Imagine, however, if you had insight of what everyone was saying about you – not just key investment commentators, but the new wave of social investors as well as the panic in the hedge funds. Everyone talking about your company. And not a self-service model of thousands of Reddit mentions churning out at a pace, but something bespoke, top-level, relevant and accurate – highlighting the conversations that are truly making a difference to your stock price.

Corporates and the financial sector need to pay attention to social media in a more consolidated and in-depth manner than ever before. It’s not just about looking at breaking news and sentiment from consumers, but also looking beyond the metrics of social media and looking at what is being said, where and by whom. GameStop is another case that demonstrates the risk of not listening.

Be it Reddit, Twitter or an investor chatroom as a platform, organisations need to be listening and understanding what is being said. A sentiment score will not highlight what an investor chat room is focusing on – qualitative and quantitative analysis combined provide greater resilience for any business, looking beyond data trends and metrics.

Technological and self-service solutions for social media listening on their own bring huge risks – huge volumes of conversation that need analysing, eliminating misinformation before finding relevance. But marry it with proper analysis and any misinterpretation risks to a business will be minimised.

The social media investor has arrived and they are not about to disappear. I’m sure there are many a fund manager today who wished they had carried out a thorough analysis of social conversation and listened to the warning bells sooner.

Social Due Diligence

Social Due Diligence